Tangible

Benefits

Proactly brings control and efficiency

resulting in tangible benefits

Proactly brings control and efficiency

resulting in tangible benefits

For every compliance completion, interest and penalty paid, if any , is also updated. Dashboard highlights these amounts in real time. By monitoring cause of delay and taking correction actions , such amounts in future can be avoided.

At times, the delay is due to over-sight by the person responsible. Regular email reminders in such case, will prove very useful.

Apart from monetary interest and penalties, non-compliance can result in more severe risks for business and owners : prosecution , stoppage of business and reputational loss

By fixing responsibility , use of reminders and realtime montioring these risks can be avoided

Period of record retention under various regulations can go upto several years , typically 5 to 8 years.

A legal notice may come after several years. Retrieving evidence of compliance becomes difficult if all such evidences are not at a single place.

Retrieve proof of compliances quickly and easily with Proactly. In almost no time, you can serach for a document based on entity, compliance period and regulator.

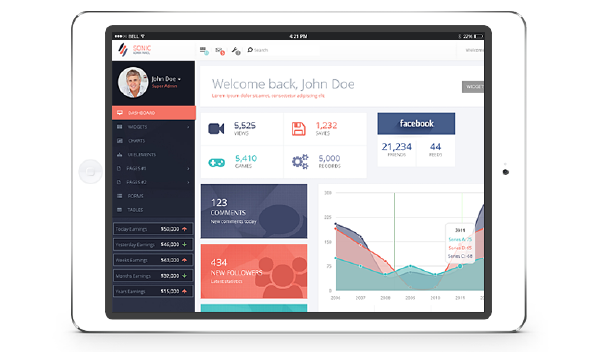

All your compliances , across all entities and departments are now visible at one place in a Dashboard

Analyse dashboard across several parameters : entity, user, compliance period, criticality. it is possible to inculate discipline and build a culture where poeple do not wait till the last moment to complete a compliance and finish it before the due date

A comprehensive system of multiple reminders for both Upcoming and overdue compliances helps users never miss a due date. These reminders can be sent via SMS also

In case of non compliance, a quick escalation system will help contain further damage.

ProActly comes with pre-loaded content for India income-tax, GST, MCA, PF, ESIC and Profession Tax

The content will get regularly updated with any date extension and procedure related changes. The experts and proactly team will constantly update blogs on recent developments which will educate the users in handling compliances correctly.

External auditor can be given view only access.

This will help auditor complete audit remotely. No hassles of sharing evidences separately. The audior can view complete compliances details and download proof of the same too.